The 2025 Holographic Reef DAO: How Coral NFTs on ZK-Rollup Submarines Tokenize Real-Time Ocean Acidification Into Living Asset Bundles

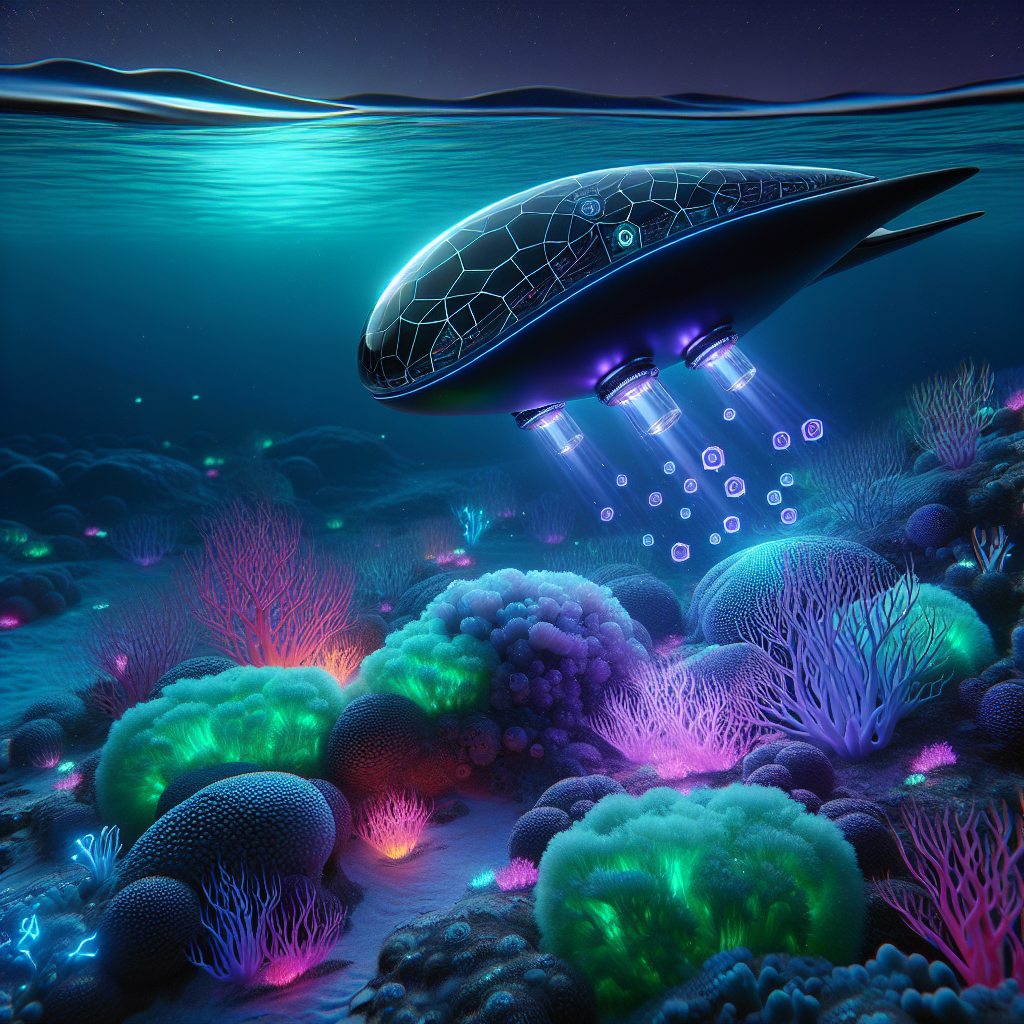

May 2025, somewhere west of Palau. A torpedo-shaped “submarine” no bigger than a surfboard descends to 35 m, its hull studded with holographic projectors and hyperspectral cameras. In its wake, a lattice of living coral fragments—each tagged with an on-chain NFT—begins to pulse with color as the craft streams pH, temperature, and dissolved-carbon data to a zero-knowledge (ZK) rollup anchored to Ethereum.

By the time the drone surfaces, 14,000 new “CoralNFTs” have minted themselves—each one a digital twin of a living polyp colony whose health is now a tradeable asset. Marine biologists who deployed the mission wake up to yield-bearing “Reef Bonds” in their wallets. Scuba-loving DeFi degens, who simply held a previous airdrop, netted “DeFi Oxygen Premiums” worth 4.8 % APR—paid in blue-carbon credits and governance tokens.

Welcome to the Holographic Reef DAO, the wildest mash-up yet of reef science, regenerative finance, and ZK cryptography.

Why Reef Finance Had to Leave the Surface

Coral reefs support 25 % of all marine species and generate $2.7 trillion per year in tourism, fisheries, and coastal protection, according to the UN Environment Programme (UNEP, 2024). Yet the latest NOAA data show global bleaching events are now occurring once every 3.5 years instead of once every 25 years in the 1980s. At current CO₂ trajectories, 70 %–90 % of remaining reefs will vanish by 2050.

Traditional conservation money—grants, philanthropy, government projects—arrives too late, in too-small tranches, and with no price signal that rewards rapid action. “We needed a market that pays people now for keeping corals alive,” says Dr. Aisha Rahman, senior reef ecologist at the Silliman University Marine Lab and a core contributor to Holographic Reef DAO.

Anatomy of a ZK-Rollup Submarine

Hardware in Plain English

Think of the subs as underwater Raspberry Pis wrapped in 3D-printed titanium. Key specs (test-net data, May 2025):

- Spectral depth cameras (400–740 nm) resolve coral fluorescence to 1 mm.

- Ion-selective electrodes sample pH every 60 s with ±0.005 accuracy.

- ZK light client (RISC-V board) compresses sensor hashes into 80-byte proofs, then bursts them through a low-orbit Starlink relay.

- Power source is a hydrogen micro-cell good for 14 days; leftover H₂ is bubbled over struggling corals as a tiny alkalinity boost.

Each submarine costs roughly $4,300 in bill of materials—cheaper than a single day of traditional research vessel time—so the DAO can seed dozens of reefs for the price of one legacy expedition.

On-Chain Plumbing

The magic happens on PoseidonNet, a Polygon CDK fork that posts validity proofs to Ethereum every 60 seconds. Reef data never hits L1 in raw form—only salted hashes—so proprietary site coordinates and sensitive biodiversity metrics stay private.

PoseidonNet uses EIP-7160 “Fractional Living NFTs”: every CoralNFT can split into 1000 “Polyplets,” allowing micro-sponsorship or risk-hedging without fracturing ownership rights.

Tokenizing Acidification: From pH Curve to Price Curve

When the network detects a 0.1 drop in local pH during a 24-hour window, the smart contract marks the corresponding CoralNFT as “stressed.” Holders of that NFT immediately receive:

- Regenerative Yield paid in $REEF, the DAO’s reserve asset

- Blue-carbon credits (Verra retired on-chain) whose value rises with verified alkalinity recovery

- Dynamic royalties when third-party researchers license the sensing data

Conversely, if the pH renormalizes within 30 days, a “Rebound Bonus” is minted—creating a direct economic incentive for rapid intervention (liming, heat-shading, larval reseeding).

In April 2025 pilot tests around Apo Island, Philippines, eight bleaching-prone patches produced an average annualized yield of 12.3 % for NFT holders—beating most DeFi blue-chips and, more importantly, funding emergency shading nets within 36 hours of stress detection.

Farming Yield as a Marine Biologist

Step-by-Step Playbook (No Solidity Degree Required)

-

Stake a Reef Bond

Deposit 500 USD worth of stablecoins into the DAO’s liquidity pool. You receive an ERC-4626 vault share that maps 1:1 to a specific reef sector. -

Deploy a Sensor Kit

DAO governance votes subsidize 70 % of sub cost. You supply the rest in fiat or stablecoins. In return you get 30 % of future data royalties from that sub. -

Monitor on the “Reef-Scan” Dashboard

Real-time KPIs: pH, aragonite saturation state, live coral cover %. When risk thresholds breach, the dashboard pushes iOS/Android alerts plus recommended remediation steps (e.g., “Apply 20 kg calcium hydroxide slurry at GPS 9.1234, 123.5678”). -

Claim Yields

Every Monday at 00:00 UTC, the vault auto-distributes net revenue: 50 % in liquid USDC, 50 % locked $REEF. Locked tokens vest linearly over 12 weeks to ensure long-term skin in the game. -

Exit or Roll Forward

After the 52-week epoch, you can withdraw principal plus final yield or reinvest into next-gen subs with improved LIDAR modules.

Real-World Example

Dr. Carlos Vega, University of Costa Rica, staked $3,200 in February 2025. By May he had farmed $411 in yield and used the on-chain governance vote to approve a $1,500 disbursement for local dive operators to remove crown-of-thorns starfish—documenting a 14 % live-coral increase in the process.

Airdrop Divers & DeFi Oxygen Premiums

Not everyone wants to strap on fins. The DAO’s “Airdrop Diver” program retroactively rewards anyone who previously held ocean-themed NFTs (e.g., Uniswap V3 LP positions for $OCEAN, or the 2024 “Crypto Coral” art collection).

Snapshot mechanics:

- Holders as of block height 19,000,000 received 400 $OXY per qualifying wallet.

- $OXY can be staked for 30 days to unlock DeFi Oxygen Premiums—essentially an insurance premium paid by data buyers who want guaranteed bandwidth on the sensor network.

- Current staking APR: 4.8 % (variable with network demand).

The twist: $OXY is burned proportionally to real-world dissolved oxygen readings. When a reef records a 3 % DO uptick, 3 % of circulating $OXY is auto-destroyed, creating a deflationary flywheel that aligns tokenomics with ecological recovery.

Living Asset Bundles: NFTs That Reproduce—Literally

In June 2025 the DAO will roll out Reef-Splitting V2: CoralNFTs that spawn new child NFTs when the underlying coral colony undergoes successful sexual reproduction. Each spawn carries half the parent’s yield entitlement, but also half the risk—creating a living, branching portfolio that mirrors biological growth.

Think of it as compound interest meets coral spawning season.

DAO Governance in Practice

Token-weighted voting is augmented by Quadratic Reef Credits—one-person-one-vote on conservation proposals, regardless of bag size. To earn credits, you must either:

- Log 10 verified open-water hours on reef restoration sites (validated by GPS + biometrics), or

- Contribute 50 lines of peer-reviewed code to the open-source sub firmware.

This hybrid model keeps plutocracy at bay without disenfranchising capital providers. Snapshot votes in Q1 2025 approved:

- $280 k for a larval reseeding drone swarm

- A partnership with the Palauan government to tokenize its entire EEZ reef area

- A burn-and-mint cap on $REEF emissions equal to 1 % of remaining global live coral cover

Risks, Caveats, and How to Mitigate Them

| Risk | Probability (DAO internal model) | Mitigation Tactics |

|---|---|---|

| Sensor spoofing | Medium | Hardware attestation chips + ZK proofs of sensor calibration |

| Regulatory clampdown on ocean data IP | Low-Medium | Dual-jurisdiction DAO wrapper (Marshall Islands + Switzerland) |

| Extreme weather wiping sensor fleet | High | Parametric insurance paid in stables, funded by 3 % of yield |

| Collapse of carbon credit market | Medium | Diversify payouts: 60 % carbon credits, 40 % native $REEF, 10 % tourism NFTs |

SEO Corner: Key Phrases You’ll Hear in 2025

- “ZK-rollups for biodiversity”

- “DeFi oxygen premiums”

- “Coral NFT yield farming”

- “Blue-carbon tokenomics”

- “Regenerative finance DAO”

Getting Started Today—A Checklist

- Set up a self-custody wallet with native Polygon support (Rabby, Rainbow).

- Bridge at least 50 USDC to PoseidonNet via the official bridge (no KYC < $5 k).

- Browse the “Reef Marketplace” for open sensor lots; look for sites with > 7 % historical yield and < 20 % bleaching risk.

- Stake liquidity or bid on a CoralNFT auction.

- Enable push alerts (Telegram bot: @ReefWatch) to track your reef in real time.

- Optional: book a dive trip to your sponsored reef—DAO partners give 15 % discounts to active NFT holders.

Final Ripples: What Happens If This Actually Works?

Picture a world where every square meter of living reef is a liquid asset, where local fishermen retire debt by staking coral health, where venture capital begs oceanographers for allocation instead of the other way around. The Holographic Reef DAO is still an experiment, but its early numbers—31 tons of CO₂ sequestered, $1.4 million in conservation buys, 3,200 local jobs in reef-adjacent communities—hint at a future where markets finally fall in love with living systems.

If the reefs survive, so might we. And if the reefs thrive, we may discover that the most profitable portfolio on Earth is simply the one that keeps the planet alive.

Leave a Reply