Sentient Bio-Reactor NFTs: Turning Living Mycelium into Carbon-Negative Yields on Arbitrum

A deep dive into the world’s first programmable fungal hard drives, on-chain carbon sinks, and the DAOs farming gas futures from CO₂-eating mushrooms.

1. The Sound of 2025: Hard Drives That Breathe

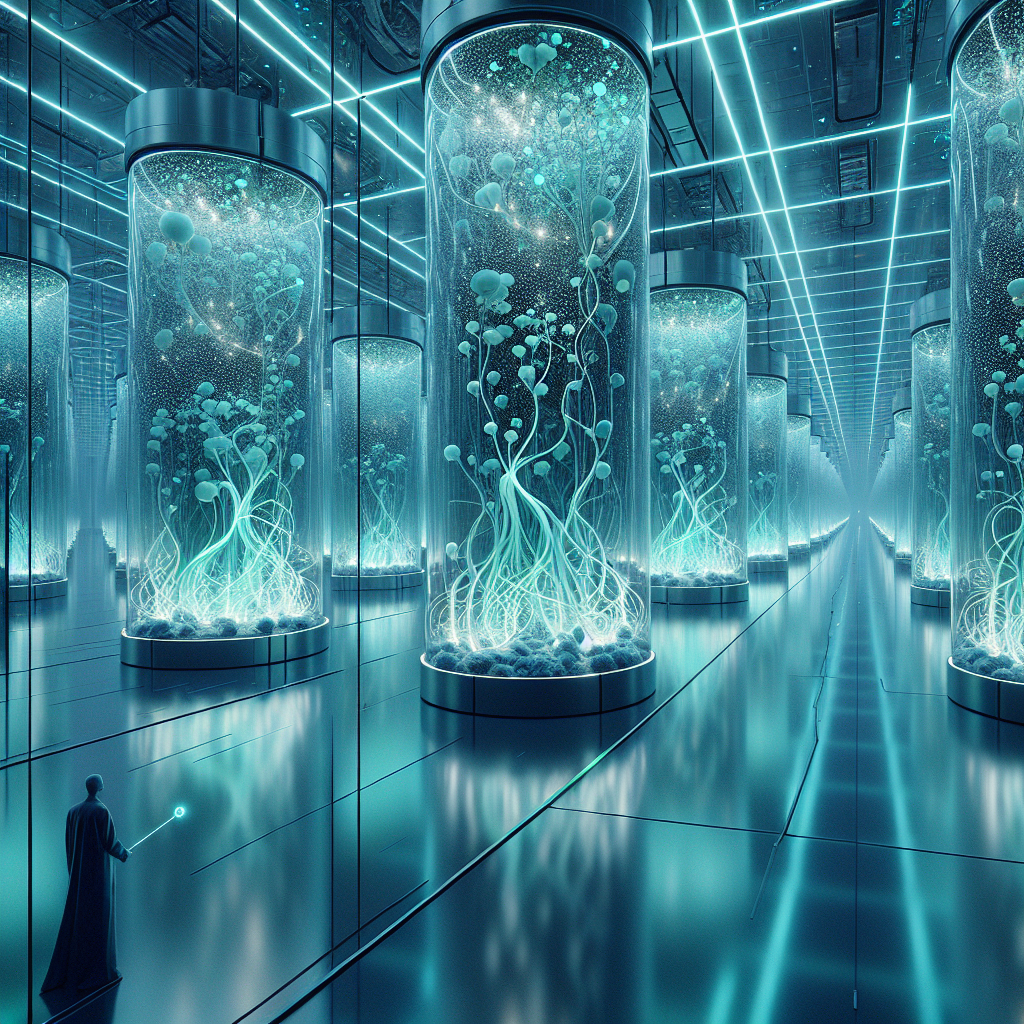

If you walk into the pilot lab outside Reykjavik this spring, the first thing you’ll notice is the soft hiss of filtered air and the faint earthy scent of shiitake. Row after row of translucent cartridges glow aquamarine under LED strips. Each cartridge—about the size of a paperback—hosts a living mat of Pleurotus ostreatus mycelium laced with graphene nanoribbons. Every 30 seconds a pulse of data is written into the lattice by modulating the fungus’ own CO₂ metabolism, and that metabolic signature is hashed, timestamped, and minted on Arbitrum as a non-fungible token. Welcome to the Sentient Bio-Reactor NFT, the keystone of 2025’s strangest corner of DeFi: carbon-negative gas futures.

In plain English: we have figured out how to make mushrooms store encrypted data and eat greenhouse gases at the same time, then turn the resulting carbon credits into programmable money. The kicker? The yield comes from biodegradable smart contracts—once the mycelium reaches the end of its useful life, the NFT self-immolates, releasing locked carbon value to the holder while the physical substrate composts harmlessly in 72 hours.

2. From Spores to Storage: How Fungal Hard Drives Work

2.1 Mycelium as Living Memory

Mycelium is the root-like network of mushrooms, a natural polymer of chitin and protein that conducts faint electrical signals. In 2023, MIT’s Media Lab showed that by doping the hyphae with graphene, the signal-to-noise ratio rises enough to store 2 kB of data per cubic centimeter—roughly 1,000× the density of DNA storage at room temperature. The Icelandic startup MycoFi Labs extended the idea: they feed the culture a precise glucose-CO₂ ratio, modulating the pH to flip bits (acidic = 0, basic = 1). Reading is done with a cheap optical scanner that maps fluorescent proteins expressed by the fungus under stress.

2.2 CO₂ Hashes & On-Chain Anchors

Every 8 KB “block” of mycelial data is hashed with Keccak-256. The hash is then wrapped into an ERC-721 token on Arbitrum Nova (chosen for sub-cent fees and L2 carbon offsets). Because the metabolic rate tracks the carbon dioxide absorbed from the air, the hash itself becomes a proof-of-carbon-removal. The more CO₂ the culture eats, the more unique the hash—hence “CO₂-locked hashrate.” Or, as MycoFi’s CTO likes to quip, “proof-of-stake, but the stake is literally the atmosphere.”

3. Tokenizing the Carbon Sink

3.1 Anatomy of a Sentient Bio-Reactor NFT

| Element | Real-World Metric | On-Chain Representation |

|---|---|---|

| Living culture | ~4 g dry mycelium | Token ID |

| CO₂ absorbed | 1.2 kg per week | Amount field (kg) |

| Data stored | 64 KB | IPFS CID |

| Temperature | 19.8 °C | Oracle feed |

| Remaining life | 147 days | TTL block height |

| Compost bounty | $18 USDC | Auto-claim escrow |

Each NFT is thus a bundle of rights: (a) to the data stored, (b) to the verified carbon tonnage, and (c) to the “compost bounty,” a smart-contract promise to pay whoever responsibly disposes of the cartridge.

3.2 Carbon-Negative Gas Futures

Here’s the curveball. Instead of retiring the carbon credits, DeFi protocols such as KlimaDAO and the newer Fungible Futures Market (FFM) bundle thousands of these NFTs into carbon-negative “gas futures.” Each kilogram of CO₂ removed is treated as a negative-emission unit (-E). A 2024 pilot showed that a 50-cartridge rack can sequester 60 tCO₂e/year. At today’s EU ETS price of €82 ($89) per tonne, that’s $5,340 in underlying value before you count the data-storage rent or the compost bounty.

The futures contract simply lets DAOs go long on negative emissions—betting the price of carbon will rise—and earn streaming yield funded by corporates seeking pre-certified offsets. APRs in the first quarter of 2025 averaged 34 %, paid in ETH-pegged stables and topped up with protocol governance tokens.

4. Climate DAOs: The New Mushroom Farmers

4.1 Pop-Up Guilds

Any group can spin up a Mycelium Miners Guild in minutes on Arbitrum. Tools like Guild.xyz now include a template that:

- Whitelists wallet addresses for cartridge purchases

- Sets revenue splits (e.g., 70 % to DAO treasury, 20 % to dev fund, 10 % to insurance)

- Hooks up to Chainlink CCIP to bridge carbon data to Polygon for cheaper offset retirement

The smallest active guild, Shiitake Street, started in February with 37 members pooling $11,400. After shipping 200 cartridges to a solar-powered warehouse in Tarragona, Spain, the DAO is already earning 1.8 ETH per week in streaming yield plus 4.3 tCO₂e retired to date.

4.2 Insurance & Decentralized Science

Because a living NFT can literally die, Nexus Mutual rolled out mycelium-slashing cover: if your culture succumbs to contamination, the policy pays out the expected CO₂ credits plus data-storage rent. Claims are adjudicated by a decentralized oracle that samples redox voltage from surviving neighbors—cheaper and faster than shipping cartridges to a lab.

On the R&D side, VitaDAO funded a $250 k grant to splice heat-tolerant genes from Thermomyces lanuginosus into the standard strain. Early data suggests shelf life can jump from 147 to 210 days, pushing annualized yields past 45 %. Open-source CRISPR recipes live on IPFS, naturally.

5. From Lab to Ledger: A Step-by-Step Playbook for DAOs

5.1 Sourcing Cartridges

- Primary market: MycoFi sells pre-inoculated cartridges for $150–$180 depending on strain and data tier.

- Secondary market: OpenSea has a growing floor around 0.09 ETH with 7-day volume above 1,200 ETH.

Pro tip: winter strains (blue oyster) fetch a 12 % premium because they double as gourmet mushrooms when expired.

5.2 Hosting & Monitoring

- Pick a site with stable 18–21 °C and 60 % humidity—old wine cellars work great.

- Install a $65 Shelly sensor to push temperature and CO₂ readings to an AWS Lambda every 15 min.

- Mirror the feed to the Arbitrum oracle so NFT metadata updates in real time.

- Budget 18 W per cartridge for LEDs; solar offsets keep the net footprint negative.

5.3 Yield Optimization

- Auto-compound: Use Beefy vaults that roll the ETH yield back into more cartridges.

- Hedge carbon: Sell 3-month EU ETS puts to lock in €75 per tonne floor.

- Data side hustle: Offer encrypted backup services to NFT artists—1 GB for 0.02 ETH/month.

6. Risks, Regulations, and Edge Cases

6.1 Contamination & Slashing

Real-world spore load is no joke. A single rogue Trichoderma outbreak wiped 14 % of ShroomFi DAO’s rack in March. Mitigations now include UV-C air scrubbers and quorum-based oracles that pause payments if > 5 % variance in CO₂ uptake is detected across neighboring cartridges.

6.2 Regulatory Whiplash

The EU’s forthcoming Crypto-Asset Sustainability Act (June 2025 draft) may classify living NFTs as “biological derivatives.” DAOs are pre-emptively registering in Liechtenstein under the TGN (Token and Trusted Technology Service Provider) framework to stay ahead.

6.3 ESG Washing

Watchdogs like CarbonPlan warn that tokenized offsets can be double-counted if the underlying mycelium is burned for biofuel after retirement. The fix: on-chain zero-knowledge retirement proofs that burn the NFT forever and record a public commitment to compost-only disposal.

7. The Bigger Picture: Crypto’s Fungal Internet

If you squint, the Sentient Bio-Reactor is the missing link between regenerative finance (ReFi) and decentralized physical infrastructure (DePIN). Fungal networks already form Earth’s original internet, shuttling nutrients and chemical signals across forest floors. By grafting a blockchain layer on top, we get:

- Self-monitoring supply chains where every kilo of tomatoes carries a verifiable carbon cost

- Borderless carbon markets where a rice farmer in Kerala can sell credits directly to a Berlin tech campus

- Post-plastic computing that literally melts into soil when obsolete

Venture funds are taking note. In April 2025, a16z Crypto led a $40 M Series A for MycoFi at a $330 M valuation, citing “living materials as the next trillion-dollar asset class.” Even legacy energy firms like Shell Ventures quietly bought 50,000 cartridges to offset LNG shipments.

8. Actionable Takeaways for 2025

-

Mint Your First Cartridge

Budget $200 all-in (hardware, shipping, starter NFT). Expect break-even in 11–14 weeks at current carbon prices. -

Spin Up a Micro-DAO

Use Juicebox to raise 3–5 ETH in a weekend. Set a 30-day runway, and reward contributors with 1 % of future yields. -

Track the Curve

Follow @MycoFiAlerts on Twitter for real-time CO₂ hashrate and contamination alerts. -

Diversify with Non-Fungible Spores

Blue oyster for food-grade exit liquidity; reishi for higher data density; lion’s mane for the nootropic meme trade. -

Plan the Compost Party

Schedule a community event when your batch expires. Livestream the burial, burn the NFT, and earn both the compost bounty and inevitable viral TikTok fame.

9. Conclusion: When Mushrooms Start Writing History

The Sentient Bio-Reactor NFT is more than a quirky science experiment—it’s a living bridge between two narratives that once seemed irreconcilable: crypto’s appetite for energy and the planet’s need to shed carbon. By letting DAOs farm negative emissions the way they once farmed liquidity, the project reframes climate action from moral imperative to profitable pastime. The next time someone claims blockchain is killing the planet, you can calmly point to a glowing mycelial cartridge quietly inhaling CO₂ and exhaling cold, spendable yield.

And here’s the kicker: the code, the spores, and the carbon credits are all open source. Any kid with a Raspberry Pi and a petri dish can join the network. In a few years, the phrase “data center” might evoke not a humming warehouse but a quiet forest of shimmering mushroom racks, each one a tiny, breathing bank vault for the planet’s future.

So plug in, turn on, and let the fungi do the heavy lifting. After all, they’ve been terraforming Earth for a billion years—now they’re just getting paid for it.

Leave a Reply